This means Sam needs to sell just over 1800 cans of the new soda in a month, to reach the break-even point. Let’s show a couple of examples of how to calculate the break-even point. Breaking even could become challenging or even impossible without adequate demand or production capability. To understand how to calculate the BEP, it’s essential to realise a few key concepts.

Find The Point Where Profit Begins

- It’s a crucial metric for business owners to determine how many units of a product or services they need to sell to cover all their costs.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Experience the benefits of credit union membership, including low fees, great rates and personalized service.

- By reducing her variable costs, Maggie would reduce the break-even point and she wouldn’t need to sell so many units to break even.

- This helps you plan the range of activities you need to reach that point, set up a turnaround time for your tasks, and stick to a timeline.

The incremental revenue beyond the break-even point (BEP) contributes toward the accumulation of more profits for the company. If a company has reached its break-even point, the company is operating at neither a net loss nor a net gain (i.e. “broken even”). If you’re having trouble hitting your break-even point or it seems unreachable, it’s time to make a change. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

Contribution Margin

With the break even result you can start to analyze the micro components that create the overall cost. Quantifying those components correctly allows you to identify areas where you may be able to cut costs. On the basis of values entered by you, the calculator will provide you with the number of units you would require to reach a break-even point. Our online calculators, converters, randomizers, and content are provided “as is”, free of charge, and without any warranty or guarantee. Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors.

What is a break-even analysis?

The main thing to understand in managerial accounting is the difference between revenues and profits. Since the expenses are greater than the revenues, these products great a loss—not a profit. The Break-Even point is where your total revenue will become exactly equal to your cost. At this point the profit will be 0 and any income earned beyond that point would start adding into your profits. You might want to add new products to sell to reach the break even point. This can be particularly useful if you are considering break even from an overall business perspective.

Volume Calculators

Just because the break-even analysis determines the number of products you need to sell, there’s no guarantee that they will sell. Conversely, businesses with high variable costs, such as manufacturing companies, may focus on reducing production costs to reach their accounting for construction companies BEP faster. For instance, what happens if raw material costs rise or if the company is forced to lower its selling price to stay competitive? Businesses can prepare for various possible outcomes by running different scenarios and making proactive decisions.

Contoh Studi Kasus BEP

Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions. Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0. First, identify your fixed costs, which are expenses that do not change regardless of the number of downloads. Suppose your fixed costs include $10,000 for app development and $2,000 for marketing, totaling $12,000.

Examples of fixed costs for a business are monthly utility expenses and rent. Businesses with higher contribution margins can break even with fewer sales, whereas those with lower margins may need significantly higher volumes to cover their fixed costs. This formula determines the total sales revenue required to reach the break-even point. Next, Barbara can translate the number of units into total sales dollars by multiplying the 2,500 units by the total sales price for each unit of $500. This computes the total number of units that must be sold in order for the company to generate enough revenues to cover all of its expenses. It’s a good idea to calculate your break-even point periodically, especially when there are changes in costs or pricing.

For a coffee shop, the variable costs would be the beans, cups, sleeves, and labor used to produce one cup of coffee. Break-even analysis compares income from sales to the fixed costs of doing business. The five components of break-even analysis are fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP).

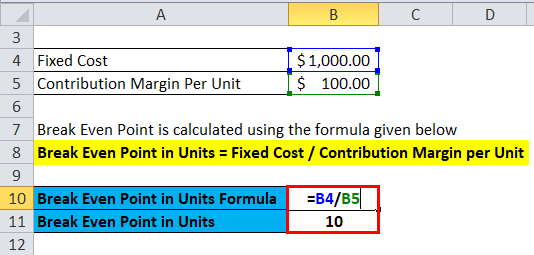

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. This section provides an overview of the methods that can be applied to calculate the break-even point. Using our Break-Even Point Calculator, you can quickly and easily calculate your break-even point and make informed decisions about your business finances. So, the break even point corresponds to the number of units you need to sell in order to break even. If you sell less than that, you make a loss, and if you sell more than that, you make a profit. Once you know the number of break even units, it will give you a target which you and your staff can aim towards.